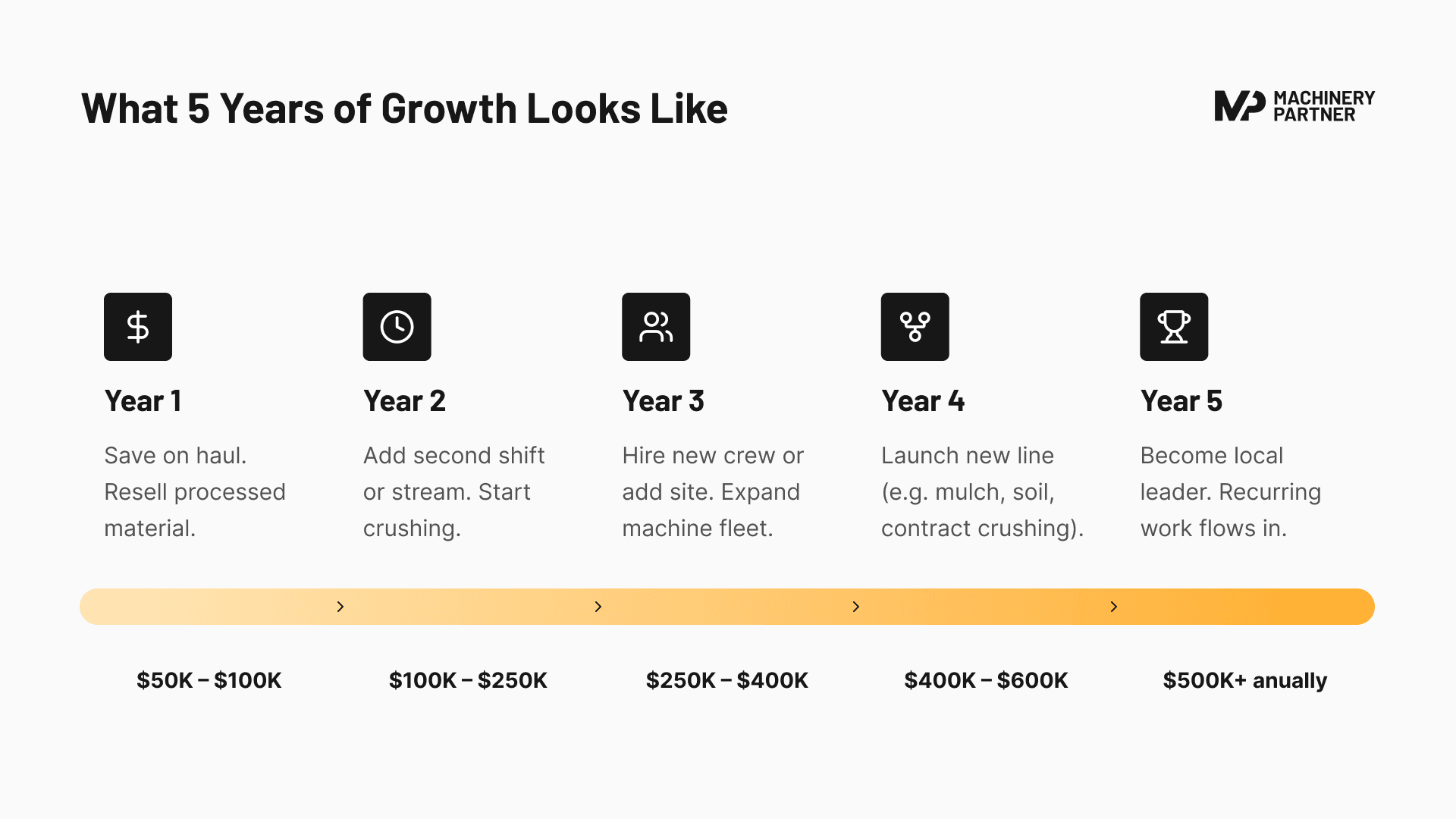

How One Machine Can Power 5 Years of Business Growth

Most contractors buy a machine to solve a specific problem. But the smart ones don’t stop there. They turn that one machine into a long-term revenue engine, one that opens up new services, lowers costs, and fuels five years of growth.

At Machinery Partner, we’ve helped hundreds of contractors shift from short-term problem-solving to long-term business building. Here’s how it plays out.

Year 1: Save and Sell

Right out of the gate, owning your own crusher, screener, or shredder cuts costs:

- You stop paying to dump.

- You reduce hauling and rental fees.

- You start stockpiling material you can resell.

Many customers report earning $50K–$100K in Year 1 just by processing what they were already throwing away.

Year 2: Add a Stream or Shift

By Year 2, customers are no longer just saving money, they’re adding new income streams:

- Starting second shifts to increase throughput

- Adding a screener to sell different product sizes

- Offering services to local contractors or builders

This is when they start crushing not just for themselves, but for others.

Revenue potential: $100K–$250K

Year 3: Expand the Team or Fleet

If demand continues (and it usually does) it’s time to scale:

- Hire a dedicated crew to run the machine full time

- Add a second jobsite or service area

- Invest in complementary machines like stackers or conveyors

At this point, the machine isn’t a piece of gear. It’s a growth driver.

Revenue potential: $250K–$400

Year 4: Launch a New Line of Business

Now that the machine is paid off and fully utilized, many contractors take the next leap:

- Start a contract crushing division

- Launch a mulch, soil, or backfill product line

- Open up rental or subcontracting services

Revenue potential: $400K–$600K

Year 5: Become the Local Leader

After five years, the contractors who invested early are thriving:

- Their names are passed around town for emergency work and subcontracting

- Their materials are in demand

- Their operation runs on predictable, recurring revenue

Revenue potential: $500K+ annually

Case Study: From One Machine to $1.2M/Year

A Midwest contractor started with a single RubbleCrusher RCJ65T to handle concrete on his own jobs. Within two years, he added a second crew. By year four, his crushing and backfill services were billing over $1.2 million annually.

He didn’t just buy equipment. He bought control. And that gave him the margin and momentum to grow.

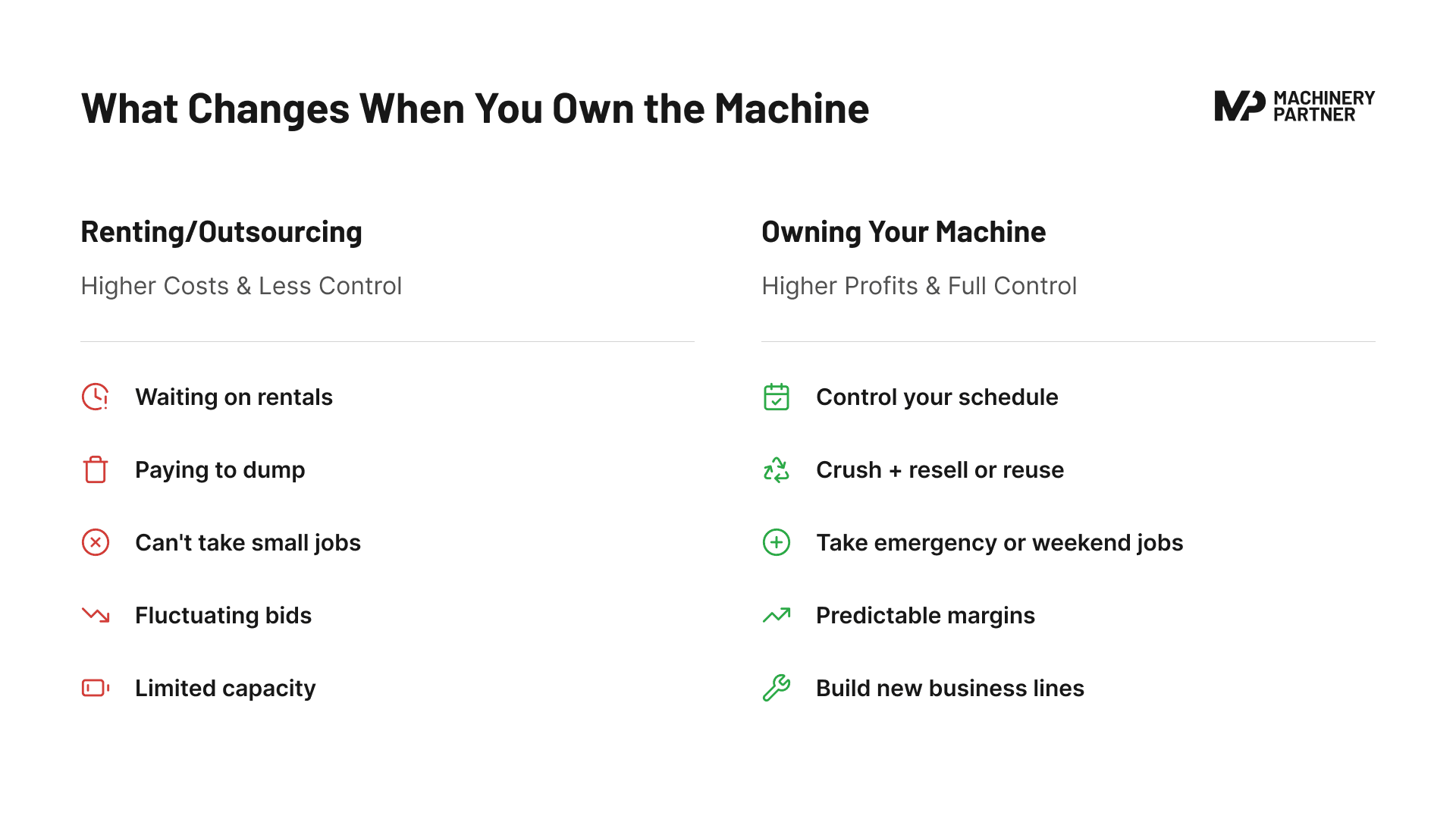

What Changes When You Own the Machine

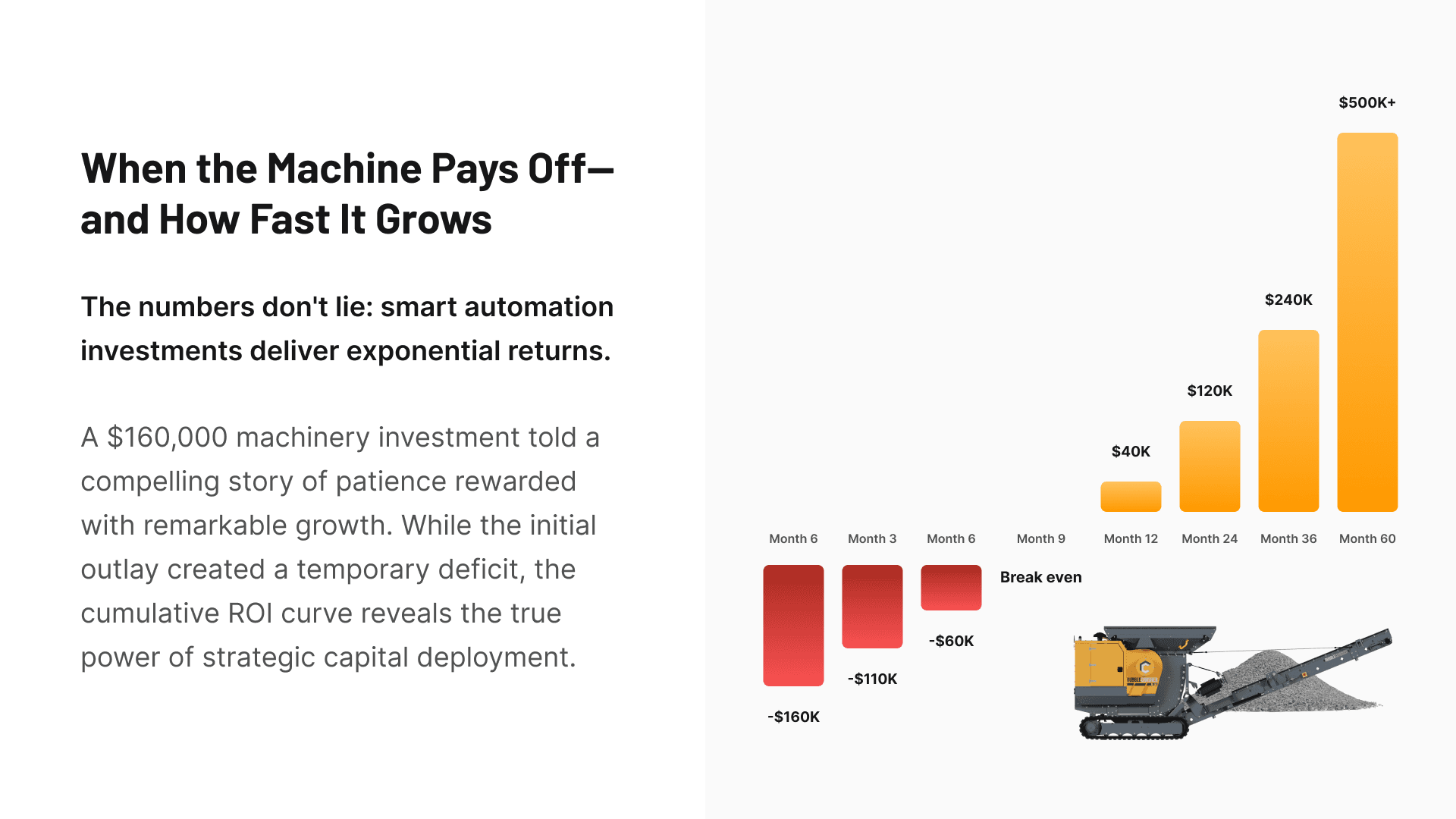

The ROI Curve

A $160,000 machine may feel like a big investment. But the ROI curve tells a different story:

- Break even: Month 12

- $240K cumulative return: By Year 3

- $500K+ return: By Year 5

Instead of bleeding cash on rentals and dump fees, you build equity and unlock long-term profit.

Start Mapping Your 5-Year Growth Plan

If you’re in this business for the long haul, ask yourself:

“Can I afford to keep renting, or is it time to own the process?”

We’ll help you:

- Forecast your ROI

- Match the right machine to your goals

- Explore financing options

Explore machines and build your path to a stronger, more profitable business.